Insurance Market Still Highly Competitive, According to IAG and Suncorp

New Zealand’s two biggest insurers have claimed that there is enough competition in the country’s general insurance market - despite their market share dominance.

IAG New Zealand and Suncorp New Zealand recently announced positive growth in their annual financial report. Combined, the two companies recorded a gross written premium (GWP) of around $7 billion in the year ending June 2024. GWP indicates the total amount customers pay for insurance coverage on policies.

Suncorp and IAG New Zealand currently hold the largest share of the country’s general insurance market—a spot they have comfortably held for years. IAG is a parent to brands such as AMI, NAC, State, and NZI. Meanwhile, Suncorp owns the Vero insurance brand and AA Insurance.

Competition in the insurance market

Healthy competition in the market is a good sign for consumers, indicating fair policy prices and a variety of insurance options. Amid geopolitical tension and supply chain disruption, more businesses are seeking to protect their assets from risk, leading to a boost in comprehensive insurance demand.

At the same time, cost of living pressures and rising interest rates have also resulted in business closures and a cut on discretionary spending – with insurance being classified under that category. Additionally, many insurers were forced to increase their insurance premiums due to increased climate risk and hazards.

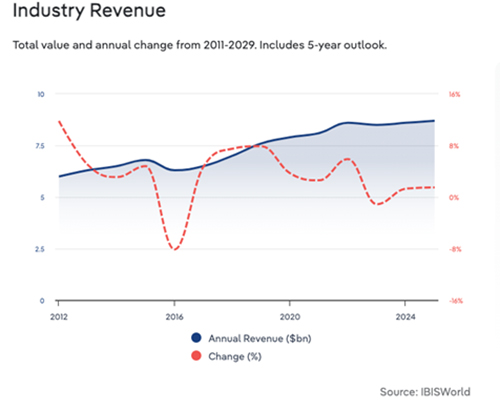

However, growth is still stable. According to IBIS World, the general insurance industry revenue has grown at a CAGR rate of 2.0% over the past 5 years.

Dominant insurers have to ‘work really hard’ to retain market share

Both IAG and Suncorp New Zealand have claimed that a lot of effort is put into ensuring they remain on top of the general insurance market.

According to Amanda Whiting, Chief Executive of IAG, the company must “work really hard” in order to retain its customers and businesses, maintaining that competition is still intense in the industry.

“But the other reason I know this is because an indication of competitiveness for me is how our organisations are innovating,”

“We've invested heavily in our technology and that just helps us be a little bit more nimble so that when there are other insurers out there offering different products, we can too. And so those things kind of indicate to me that it's a pretty competitive market,” she said.

Amanda mentions that IAG has leveraged AI tools to quickly identify vehicle damage, as well as create repair hubs for customers who need them. These additions simplify the claims process for customers, reduce costs, and improve customer service.

Suncorp NZ’s Chief Executive Jimmy Higgins echoes this statement, referring to the roadblock it faced in 2017 by the Commerce Commission. In 2017, Suncorp’s subsidiary Vero Insurance tried to buy Tower Insurance but was blocked by the Commerce Commission due to competition concerns. Vero has since sold its 19.9% stake in Tower Insurance to Bain Capital, an American private investment firm.

Higgins cites this as a critical point on how the market was still competitive for general insurance.

“There are certain barriers to entry in being an underwriter in New Zealand, and capital requirements set by the Reserve Bank are one of them. But you know, we’ve got a lot of brokers in New Zealand, and we obviously manufacture the product and it's sold through the various broker channels and corporate partners,”

“So the distribution network in New Zealand is quite broad and I do think it is competitive because we do see that, and what we have seen certainly more recently is foreign capital coming into New Zealand backing underwriters that can afford more so in the corporate world than in the consumer world,” Higgins said.

Suncorp is currently New Zealand’s second-largest insurer. When asked if they plan to become the first in the near future, Higgins says it involves a lot of consideration.

“While it’s a question of whether we want to be number one, you know the thing about that is you could just buy risk at any price to get your market share,” he said.

“But that would be financially and economically irresponsible, let alone socially irresponsible. We need to continually prove social licence operating and that means that when we attract new customers, we have to be able to provide a price point that is reasonable. But more importantly we have to be able to service that. We have to be able to respond to that when it comes to claim time.”

Suncorp's annual GWP rose 17.3% to $2.8 billion in 2024. Meanwhile, IAG NZ’s GWP jumped 15% to $4.12 billion in the same period. Both insurers recorded a jump in insurance profits.

Key takeaway

For many businesses navigating a turbulent time, insurance remains one of the most important investments that can safeguard them from risk and protect their assets. The healthy competition for New Zealand’s biggest insurers reflects the growing demand in the market, which is forecasted to stay in the months ahead.

Bonded NZ helps businesses remain efficient in economic uncertainties through comprehensive and tailored business insurance. Whether it's public liability or professional indemnity insurance, our cost-effective options help them secure their business at every angle.

For more information about our services, contact our team today.

=

=